Free Checking Accounts With Perks Come Standard

Checking accounts that fit your needs.

Wheelhouse Checking accounts deliver you the most competitive perks that get you access to thousands of ATMs and Debit Rewards

Contactless. Safe. Secure.

Enjoy the convenience of having your Wheelhouse Cards digitally stored on your mobile device. Use it to pay for contactless, safe, and secure transactions.

Security Is Our Top Priority.

Protecting your account information and providing a safe banking is one of our top priorities.

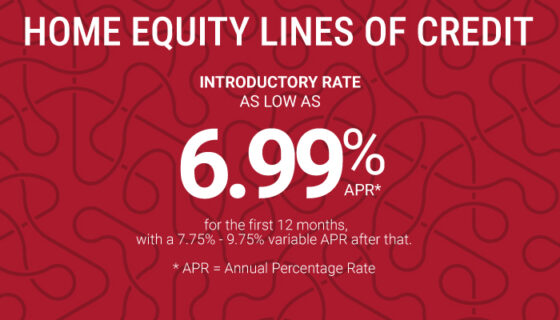

HELOC

Rates are effective as of March 1, 2026 and are subject to change without notice. Rates are based on creditworthiness. Introductory rate is fixed for the first 12 months.

Certificates

Rates are effective as of January 20, 2026 and are subject to change without notice. Earn up to 3.85% APY* on an 8-month Term or IRA Certificate.

Sharpen Your Knowledge with our Blog |

||

|

||

Notice of Elections

![]()

Credit Union members interested in having their name placed in nomination for the Board of Directors must do so prior to April 5, 2026. You may submit your application online or send your name to the Nominating Committee for consideration, or submit a petition signed by the greater of one hundred (100) Credit Union members to the Nominating Committee at:

Wheelhouse Credit Union

Attn: Nominating Committee

PO Box 719099

San Diego CA 92171

The Annual Meeting of the Membership and election of volunteer officials will be held on Tuesday, May 26, 2026, at 4:00pm – Wheelhouse Credit Union, 9212 Balboa Ave, San Diego, CA. To reserve your seat at the Annual Meeting, click here or call 619-297-4835.

TRAILBLAZE CHALLENGE

![]()

Make your miles matter. Wheelhouse is proud to be the presenting sponsor of the Trailblaze Challenge San Diego. Join as a hiker or donate to make wishes happen.

Affordable Housing

We’re committed to helping our Members access affordable housing solutions. That’s why we’re excited to share that our Manufactured Home Loans now feature low rates.

We were born in San Diego in 1934 to serve our City employees. We grew up here; and like you, we changed when we got older. In 2018, we rebranded to Wheelhouse Credit Union; a name that better represents our friendly and inclusive culture. Although our name changed, we remain true to ourselves. We provide the same financial solutions as a bank so that you can simplify your life and manage your finances in one spot.