Energy Efficient Loan Program

Wheelhouse has financed over 244 million kilowatt hours of clean energy

The Benefits of Green Financing

-

Tax Credits

Last chance to get a 30% federal tax credit and sell your extra energy with net metering. For tax advice and to determine eligibility for federal tax credits, consult a professional advisor.

-

Lower your monthly utilities

Energy-efficient loans can help you save on electricity by financing a solar power system, home battery, and high-efficiency appliances. Plus, conserve water with a xeriscape yard.

-

Go Green

Show our planet some love and support clean energy usage.

Solar Loans

Empower Your Home with Solar: A Sustainable Energy Solution

We work directly with our valued partners and Preferred Licensed contractors throughout the state of California. Switching to solar is easy. With low rates and loans up to $80,000, our goal is that solar actually saves you money today and tomorrow.

Home Battery Energy System Loans

Store Your Energy, Save More Money

A Home Battery Storage System will allow you to never worry about when you might lose power. Store the solar energy you generate during the day and use it at night to shield yourself from grid rate increases. You can apply the federal solar tax credit savings to both your solar energy system and battery storage system. We work with over 100 renewable energy installers to make the process seamless for you.

Roofing and Insulation

Store Your Energy, Save More MoneyBoost Your Home’s Comfort and Value

Adding energy-efficient roofing and insulation to your home is an effective way to enhance energy savings and improve indoor comfort. Energy-efficient roofing reflects more sunlight, reducing heat absorption, while quality insulation helps maintain a consistent temperature by minimizing heat transfer. Together, these upgrades significantly lower heating and cooling costs, making your home more environmentally friendly and cost-efficient. Additionally, they can increase the lifespan of your HVAC system, reduce carbon emissions, and potentially qualify you for energy rebates or incentives.

Heating & Air Conditioning Loans

Energy-Efficient HVAC boost comfort and lowers utility bills

Financing heating and air conditioning systems allows you to enhance your home’s comfort and energy efficiency without the burden of a large upfront cost. By spreading the expense over manageable payments, you can invest in modern, high-efficiency HVAC systems that lower your utility bills and improve overall climate control. Upgrading to energy-efficient systems often results in additional rebates or incentives, further maximizing the financial benefits of your investment.

Energy Efficient Windows and Doors

Enhance Your Home’s Value and Comfort

Adding energy-efficient windows and doors to your home is a smart investment that enhances both comfort and savings. These upgrades help reduce heat loss during winter and minimize heat gain in summer, leading to lower energy bills year-round. By improving insulation and reducing drafts, energy-efficient windows and doors also contribute to a more consistent indoor climate, making your home more comfortable. Additionally, they boost your home's value and can qualify you for rebates or tax incentives, making it an eco-friendly choice with long-term benefits.

Car Charging System Loans

Store Your Energy, Save More Money

Installing a car charging system at home offers unmatched convenience and efficiency for electric vehicle (EV) owners, easily and quickly power up your EV overnight, ensuring it’s ready for your daily commute. Eliminate the need for frequent trips to public charging stations but also provide a more reliable and consistent charge. We work with over 100 renewable energy installers to make the process seamless for you.

Xeriscape Landscaping Loans

Transform your yard and save water and money

Financing xeriscape landscaping for your home offers a practical and cost-effective way to enhance your outdoor space while conserving water. By spreading the cost over time, you can invest in drought-tolerant plants, efficient irrigation systems, and sustainable design features without a significant upfront expense. This not only helps reduce water bills and maintenance costs but also increases your home's curb appeal and overall value.

Electrification of Home

Energy-efficient solutions for a sustainable future

Electrifying your home offers numerous benefits, from increased energy efficiency to cost savings and reduced carbon emissions. Heat pump HVAC systems and water heaters provide efficient climate control and hot water by using electricity instead of fossil fuels, often cutting energy bills significantly. Electric upgrades, including modern wiring, enhance safety and power capacity for new appliances. Induction cooktops offer faster, precise cooking with less wasted heat, while heat pump dryers use less energy than traditional models, lowering utility costs. Overall, home electrification is an eco-friendly, cost-effective solution for modern living.

LED Landscape Lighting

Enhance Your Home, Reduce Your Costs

LED landscape lighting uses less energy than traditional lighting, resulting in significant cost savings over time. LED lights consume up to 90% less energy than traditional incandescent bulbs, which can lead to lower electricity bills and a reduced carbon footprint.

Save 0.25% APR*1 off your Energy-Efficient Loan

By opening an Inspired Checking account and setting up automatic loan payments from this new account, you can enjoy a 0.25% APR* discount on your eligible loan. This offer not only helps you save on interest costs but also simplifies your financial management by streamlining payments through one convenient account. This promotion applies to each eligible loan, making it a valuable opportunity to maximize your savings.

Applying for an Energy Efficient Loan is fast and easy.

Get approved in 3 steps.

-

1

Tell us about your project.

Defining the scope of your home solar project involves determining your energy needs, budget, system size, and any necessary upgrades to your roof or electrical infrastructure. -

2

Tell us about yourself.

Driver’s License or other form of government issued identification -

3

Employment information

Paystub or Gross Monthly Income and your work address and telephone number

If you have a joint applicant, the information above will be needed for both.

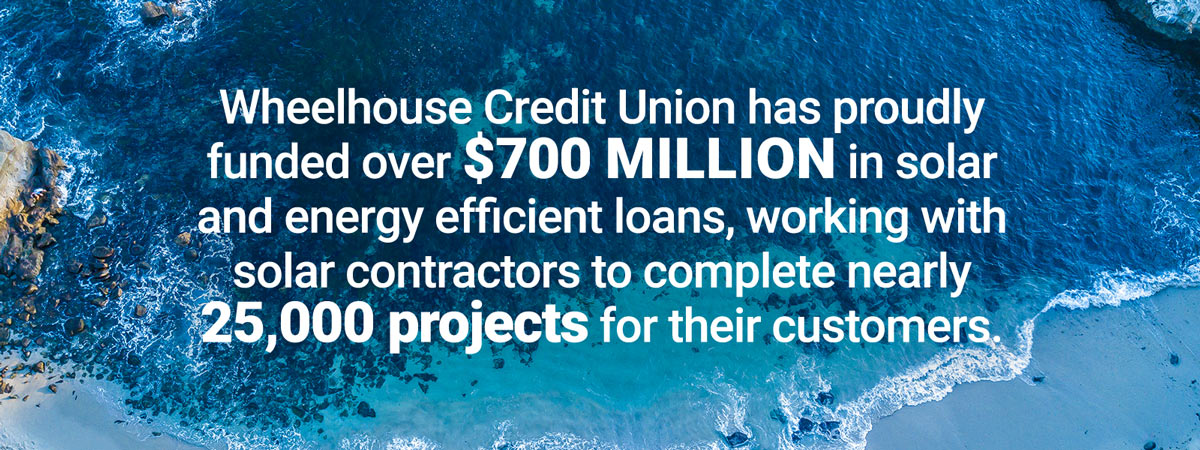

Wheelhouse is Committed To Sustainability

Sustainability is rooted in our core values and we know that together we can significantly reduce our carbon footprint, lessen greenhouse gas emissions and decrease our dependence on fossil fuels. We support organizations in San Diego that are reducing climate change impact and improving the environment we live in.

Ready to open a Wheelhouse Account?

Disclosures

* APY = Annual Percentage Yield. Rates are effective as of 02/05/2026 and are subject to change without notice. Loan approval, terms, and funding are not contingent upon the Borrower’s ability to claim or receive any tax credit or rebate.

1Discounted rate stated includes discount for setting up automatic loan payments from your Inspired or Inspired Plus Checking Account. All loans require approval of credit and collateral. Rates may change without notice and depend on creditworthiness, loan term, and applicable discounts. To qualify for a 0.25% discounted rate, borrowers must set up automatic loan payments from their Inspired Checking Account for new eligible loans. Inspired and Inspired Plus Checking require the following within 90 days of account opening: initial minimum deposit of $10, at least $450 in recurring monthly direct deposits, active digital banking registration, and enrollment in eStatements. Additionally, the Inspired Plus Checking account requires a $9 monthly fee to access the Perks program. If the requirements are not met and maintained, your account will be converted to a Basic or Basic Plus Checking account, which may come with different terms, conditions, and restrictions. Additionally, access to the Perks Program will be removed. Please note that Inspired and Inspired Plus Checking accounts are variable-rate accounts, and any fees may reduce the earnings on your account. To qualify for an annual percentage yield (APY) of 3.00%, you must complete at least 20 qualifying purchase transactions each month using your Wheelhouse Visa® debit card associated with an Inspired or Inspired Plus Checking account. There is no minimum balance required to earn dividends. Contact a Team Member for further information. Other terms, conditions, and restrictions may apply. Membership is required.

Other restrictions, terms, and conditions may apply. Membership required.